Brutally Boring Stock Photo Earnings – May 2021

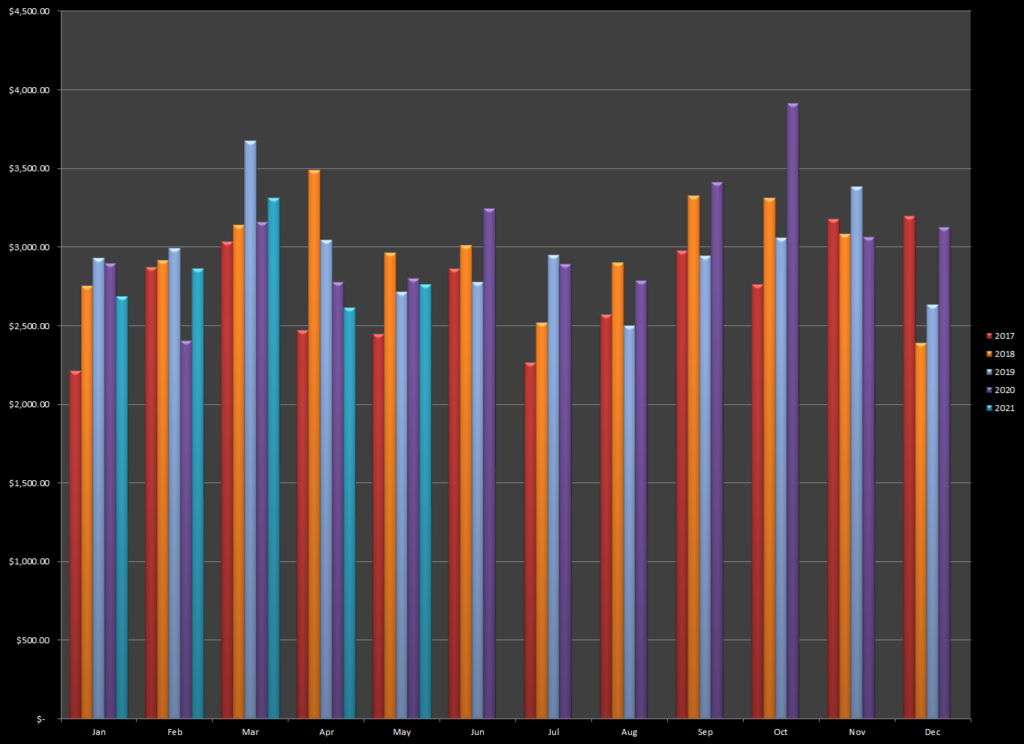

Sorry, Alex for stealing your approach, but everything about May seemed to be more of the same. Just look at the columns for May in the graph:

This May’s results of $2759 was almost the same as the previous 4 years of earnings. In May 2018 I had 10,000 images on Deposit Photos, this May I had 16800 – same earnings from a 60% increase in assets. No wonder there isn’t the same enthusiasm for stock photography as there was a few years back. But, putting negativity aside, there are some bright spots although you need to remove your sunglasses to see them!

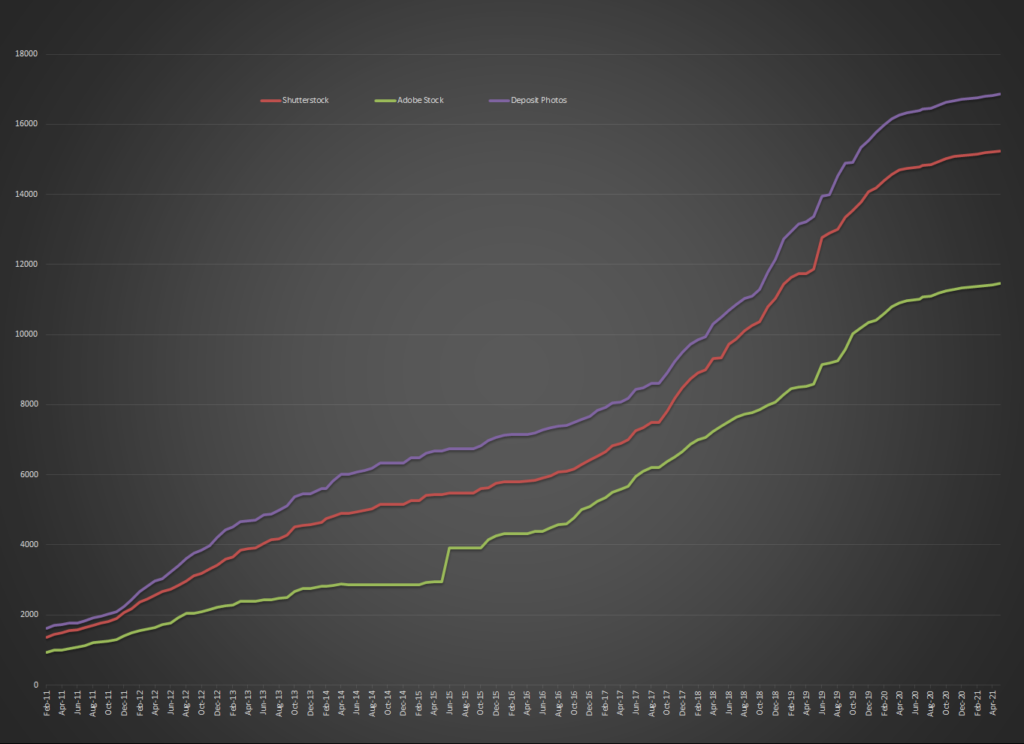

Just a quick update on file uploading. As I mentioned in previous reports, the rate of uploads has significantly reduced for me with the endless lack of travel. However, I do add a few each month and so my overall growth on three agencies looks like this:

You can see the real easing of the growth curve here on all the agencies I support.

So where are the promised highlights? Getty/iStock continues to be reasonably successful with earnings paid out in May of $481. A big drop from the super $674 in April, but still pretty reasonable. Adobe just beat the $500 mark and SS was in its usual place at $644. But the first highlight came from EyeEM. I had planned to close that account because I thought there was a good chance that my own files on iStock would sell in place of the ones that EyeEM has (there must be many duplicates there). If my own file sells, I get the full amount rather than share it with EyeEM. However, this month they sold some images on Adobe earlier in the month and then came in with a couple of >$20 sales from Getty to bring the total to $95. It is a long time since I have seen that at that agency. Canva was a bit better at $130 although I really miss the long running “doubling” of the previous month which paid out almost $300 a month for 12 months or so. But the real surprise was that my social media efforts seem to be paying off with 4 distinct sales on Fine Art America in May to bring in about $250. Two of them were prints and two were products, but, even so, it was nice to see them. I have continued to add more images to my Fine Art collection over there and now have almost 1500 images for sale. The images that sold as prints were:

As you can see, my enthusiasm for stock is going down, but is balanced by my energy in trying to get this prints to sell!

On the stock side, I did have a $60 net sale on Alamy for this foreclosure sign outside a townhouse. I did suggest to my premium members that eviction and foreclosure images would be worth creating and this is one where I followed my own advice:

It is a composite (which I am sure you can tell) using an old sign and a current photo of the front of my house. There were also a couple of $30 sales on Shutterstock, but nothing very exciting. Total video sales were $83 and that included a $47 license change on Pond5 on a previous purchase. So you can see how exciting the rest of the video sales were in May!

Well, what more can I say? Boring, indeed!

Still, pretty decent results, although I agree, it looks like growth potential is very limited when it comes to micros.

You mentioned the increase in the number of assets in your portfolio. I have a similar number in mine, and after many years of submitting have come to the realization that many pictures are like cheese some age well and continue to sell for many years while others are best when new. Some of my best sellers from six or seven years ago are very quiet now but other old files seem to come to life for no apparent reason. That’s why stock is exciting.

Yes, I do find that. Also, the successful files on one agency are not necessarily successful on another, which all goes to prove that you really need to get the images on as many reasonable images as possible.