December Earnings and Review of 2012 for Stock Photography

The end of December is a time for reflection and setting of new targets for the coming year and so I decided to pull out all the stops and do a detailed analysis of how my efforts in the Stock Photography business are going. This is going to be a long posting, so relax and take the information in stages!

First, how did December pan out. Not great (although in perspective for the whole of 2012, it was a reasonable month) with total sales of $1723. The month was fine for the first two weeks, but then it just dried up – especially with iStock which put in the lowest monthly earnings all year, even though I have continued to add files each week to the site. By contrast, Shutterstock had the third best performance of the year after November and October. I hope iStock is not headed off a cliff this coming year. To help explain the results, Christmas this year fell in the week, and I am sure many people – buyers included – had most of the last two weeks of the month on vacation and certainly not thinking about licensing stock images. One bright spark in the month – I had a $90 single download on Shutterstock of my favorite cat:

My favorite cat stock photo

I joined a new site in late November – Photospin. I had most of my images online by the start of the month, and was amazed to see that the earnings had reached $50 in the first week. However, they stayed there, and, in fact, fell back a bit to $47. As I understand their business model, each buyer has a subscription for the month, and your share of the downloads from that buyer give you a share of the revenue from the buyer. So if you are downloaded more frequently, you end up with a bigger share of the buyer’s payment. I’m not sure I like it so far – I had 200+ downloads in the month for a return per download of 25c or so – quite a bit lower than most of the other sites and I hope that the site doesn’t cannibalize the other stock agencies. I think I will watch this one for a month or two before deciding whether to stay there and accept even lower revenue per downloaded file. None of the other sites stood out for particular comment this month, so here are the graphs.

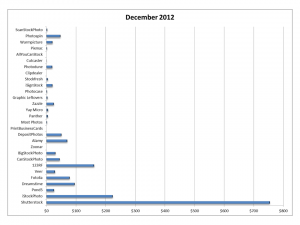

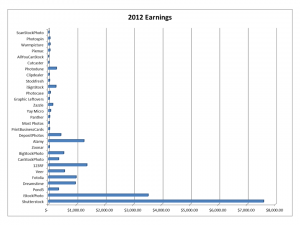

First up is the income per site in December. Here you can see the big lead that Shutterstock has over the other sites:

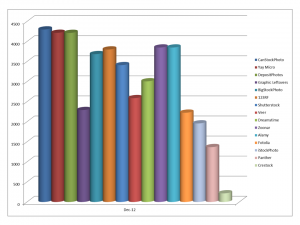

I have continued to add files to all sites during the year, with more added in December from a trip to Florida and one to the Los Angeles area (see the world as a stock photographer!). Here are the current numbers for files online in each of the main agencies.

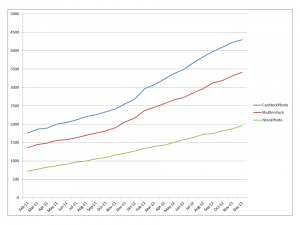

My online files have been growing in a straight line fashion through the year – I try to add about 100 per month on average:

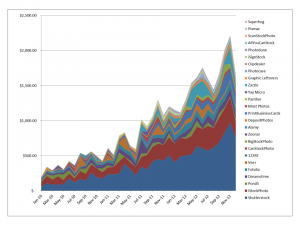

Finally, my usual graph of growth of earnings through 2010 – 2012. Still looks like a positive picture, although the last month spoils the pattern a bit! I’ve also added the graph that shows earnings per site for the whole of 2012 to let you see some of the detail that is hidden in the smaller segments of the graph.

With the year over, I then decided to look at whether things were getting worse or better in the world of stock photography. I’ve continued to add images to each site, but are my efforts being rewarded with additional sales? That brings us to the first question – I have been showing the images that are online in each of the various sites, however, I have taken more than that, but they have been rejected. In some cases this is because the site doesn’t take editorial shots (eg Canstockphoto), or they just have rejected the image because they consider it not technically acceptable, duplicative, or just not saleable. Warmpicture is the exception to this – the site relies on the artist to filter their images and only upload ones that are acceptable. On that site I uploaded all the shots that I thought had potential – 5071 images. So, should I calculate earnings based on 5071 images that have been keyworded and uploaded, or on the ones that the agency accepted? As I don’t pay out any cash to take these images (apart from vacation costs), I decided that the images that were rejected from a site didn’t cost much (if anything) and so using the online images was an accurate way of representing my progress. If I start to see a much higher rejection rate in the future, then my analysis will have to change, but there is no sign of that at present. Hence, my analysis is based on images online at the end of the month in question.

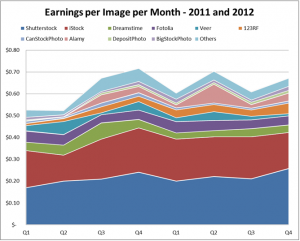

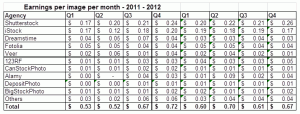

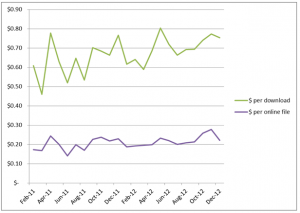

First piece of evidence is the graph that shows the earnings per image per month through the past two years. I’ve been collecting stats on the larger sites for 24 months, and so I was able to calculate how much I make on average per image on the 10 largest sites and I grouped the smaller sites together into one category and used an average number of images. Earnings from this last group are around 5-10% of my total, so they aren’t that significant.

What is interesting, and a bit of a relief, in this graph is that there does not seem to be a fall off in the earnings I get from each online image. That tells me that as long as I continue to add images of similar quality and saleability going forward, I should see a proportional increase in income. I’ve got some graphs coming up that look at Shutterstock, iStock and Fotolia in a little more detail so I’ll not comment on those at the moment. It is interesting to see how the other small sites add up though – each one may not be much on its own, but in aggregate they make a difference. The other thing of note is that if I ignore Q1 and Q2 of 2011, the business (for me) is relatively flat – bouncing between $0.60 and $0.70 per image per month on average. On the bright side, that means that the industry is not heading off a cliff in terms of rewards to contributors – it isn’t getting better though, and inflation is slowly eating away at the real value of these earnings. The underlying table behind the numbers is shown next. There is obviously some rounding in the values (to the closest 1c). This shows that Alamy is very variable in earnings – a couple of big sales makes a big difference to a quarter. Also 123RF has shown some nice growth for me although I do have a fair amount of referral earnings on that site that will be impacting the results a little.

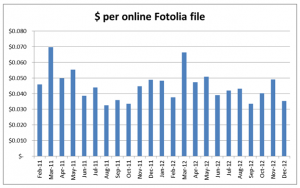

I then looked at three sites in more detail. First Fotolia. This one is an annoying site for me as I religiously add all my images each month and they consistently reject them. It is clear that they like studio shots and isolations – nature and landscape/travel shots are almost always rejected. As a result, I only have 2225 images online with Fotolia. As a result, my earnings per image are a bit higher than I would expect from the total revenue from the site, and shows some really nice peaks in March each year – I hope that continues! In general, the earnings are staying consistent with the images they accept. As my sales are often of the travel variety, I just wish they would take a few more!

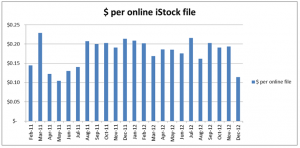

Next up is iStock. December was a rotten month on this site with earnings at the lowest point of the year, but this is masked a bit by better earnings in October and November in the quarterly results. The scale of the drop can be seen in this graph though – lowest earnings per file since May 2011. Apart from this one month, iStock has been performing well for me – a big bump in mid 2011 when I think the Photo+ program was introduced, and reasonably consistent earnings per file ever since.

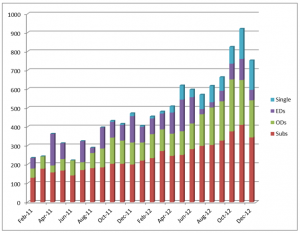

Shutterstock is the most important site for me, and so it deserves a little more analysis. My first graph shows the contribution of the different download licenses to my earnings:

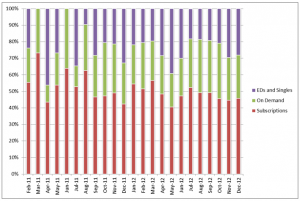

What is interesting about this graph is (apart from the growth) the increasing contribution of Single License downloads. As mentioned in an earlier post, Enhanced Downloads have fallen back a bit for me, but the Single ones have picked up. I did a different look at this issue with a graph that plots the percentage of the download types each month, which shows that the proportion of subscription earnings has stayed pretty constant through the period:

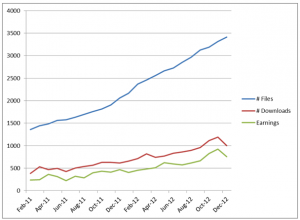

I then plotted downloads and earnings against online files, followed by earnings per download and earnings per online file on Shutterstock.

Interestingly, the earnings per download have been rising (as those higher priced single downloads kicked in, but so has the earnings per online file. This last graph shows a nice uptick from about 18c per online file to perhaps 23c in late 2012. Either my images are getting better, or Shutterstock is increasing its market share – probably the latter! So of all the sites to keep happy, Shutterstock wins on many counts!

Bottom line – the pattern I saw earlier in the year about the earnings being proportional to the images online continues to hold. With my type of portfolio and spread of images across agencies, it still looks like $0.65 – $0.70 per online image per month is a consistent earnings pattern. I’ve doubled my earnings each year so far, but that is now implying that I need to go from 3400 images on the likes of Shutterstock to almost 7000 in 12 months! That would be a big challenge and so perhaps I’ll target a move from $20K to $26K as my earnings target for 2013.

Did you also get only 8 or 9 cents for your first sold photos on photospin? I uploaded 500 there and the first day 2 sells but only 8 and 9 cents.

Photospin is a funny site – I understand that we, as contributors, get a share of the money paid in by buyers for their subscriptions. Our share is calculated based on the proportion of our downloads compared to the total. So if a buyer only downloads 10 images and 2 of them are mine, then I get 20% of their subscription. If they take 100 and I have one, I get 1% of that subscription. Hence, the amount per download varies from 8c to several dollars based on the buyer activity. It is not easy to accept 8c, but overall, it seems to earn a reasonable amount of money per month – $30 or so for me.

Steve

Yes i am selling some photos there now. It is also hard to see what money you get for what photo. the reports are very small and also a overview of your accepted photos in portfolio is hard to find or not there. Strange but will see at the end of the month what ratio it will bring.