Earnings from stock photography (and video) in March 2018

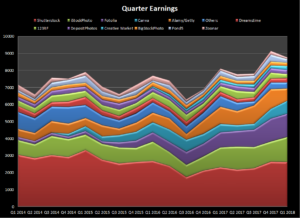

March turned out to be a pretty decent month for earnings, with a total of $3099. Now that I am focusing more on video, I can report that $198 of that was from video sales! For a change, here is a quarter view of earnings with a very colorful approach to brighten your day:

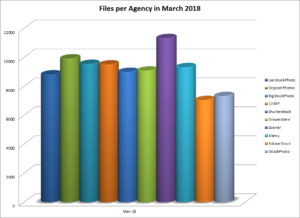

As you can see, the final quarter of 2017 was my best ever, but this first quarter was not far behind. Most of the sites did pretty well in March. Shutterstock was just less than $900, but iStock really excelled in the month (of February) to come in with $579. Easily the most I have earned from that site. Looking at the specific images that sold on that site, my shots from a trip to South West Virginia to the New River Gorge area really paid off. I sold three of this image:

for $84 and this one of the bridge has earned $558 in total with the majority coming from iStock (not all in February!):

I certainly hope iStock is going to maintain this blistering pace! Adobe Stock was not far behind with $515 – again a monthly record. My next biggest earner was Canva with $273.

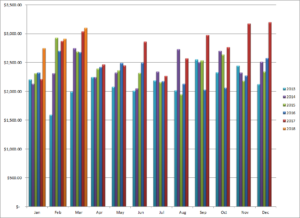

On my monthly chart, there is also a pretty nice pattern appearing:

As you can see, almost all of the months in late 2017 and now 2018 have been higher than the same month in the previous year. February was not just enough to beat a record set back in 2015, but it was close and now March has just crept about March 2017.As you can also see, my earnings are not particularly seasonal. I do have tax images that sell at this time of the year, but I don’t tend to have big sales around each of the major holidays. The summer is normally lower, but time will tell if this pattern is repeated again this year.

Notable large sales in March came from a $71 sale of my bag of ice on Shutterstock followed by a later $30 sale:

That one has earned over $1730 in its life. Not bad for a $10 bag of ice!

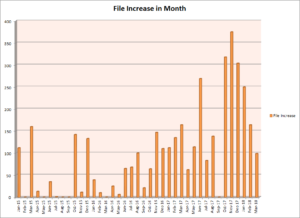

In the month I only added around 100 images. I was on vacation in Spain and Italy for part of the month and so am working through a big collection of images at the moment and haven’t had much opportunity to do my uploads as yet:

This then gives me the following totals on various sites I submit to:

Looking forward, I need to work on my latest images (and some videos that I mentioned in my last post). Quite a number of them are editorial this time – we were in Valencia at the time of the La Fallas festival where each neighborhood creates incredibly detailed statues and models and then they have a massive fireworks festival and burn their statues to the ground. We weren’t there for the burning, but there were plenty of fantastic creations around every corner in the city:

That’s quite a good month! Congrats on that, and thanks for sharing 😉

Thanks Bjorn!

Congratulations on a good result. The photo with the mist is beautiful!

Hi Steve,

How has alamy been for the beginning of 2018 for you? Standard? Worse then normal? Better?

At a gross level, I think it is much slower – fewer sales and less money per sale. Last year my gross revenue was $2450, this year so far it is $436

Congrats for your site and useful posts!

How did you decide which images to go on Alamy and which ones on SS, Istock?

As you know pricing is different and sometimes you fight against yourself publishing an image on all sites.

Hi Lorenzo

Yes, I do submit to about 16 sites at present, and I submit all the same images to all sites (apart from the ones that don’t take editorial shots. I decided (and there are a few posts about this) that buyers on Alamy don’t normally search for cheaper copies on other sites and so I don’t see any benefit in trying to decide which is premium and which is not. Let the buyers choose the image and the agency they prefer. That means that I now submit RF to Alamy. I did have some earlier ones as RM from the days when you couldn’t do RF Editorial on Alamy, but now they are all RF. Hope that helps.

Steve

Thanks for all your posts they’re all very helpful. I’m hoping you can help me out with something I’ve been a stock photographer for a while, but have only brushed the surface of videos. I was uploading QuickTime format with a codex called photo jpeg. Recently Premiere Pro has retired that codex and I find myself completely disabled and lost. Do you have any suggestions on how I can find new settings for my media experts. Every time I ask one of the stock agencies they just refer me back to their requirements page which seems to confuse me even more.

That is a very good question. I just noticed that my copy of Premiere has updated to the latest version and the Photo Jpeg codec is missing. I’ll do some investigating on which codec will meet the needs of the agencies now!

The likely workaround for a while is to export with an uncompressed codec to a hard drive on your system. The file will be very big at this stage. Then you can use MPEG StreamClip to take in this uncompressed file and export it using PhotoJpeg. Mpeg Streamclip is a free little App that works very well at converting video from one file format to another.

Thanks so much I will look into it!

Hi Taya. I did try the export to uncompressed from premiere and then re-encoding using MpegStreamClip – that works fine. Unfortunate that it is an extra step, but at least it works for as long as Adobe Stock accepts PhotoJpeg files. There is more debate about this on the Microstock Group forum, but I think you started that thread?

Your blog had been an inspiration recently.

Looking at your end quarter 2017 graph.

With al the colours of the different agents, with each agent rising and falling and other compensating, and then looking at their combined totals.

Years gone by my graph would have been made of just one colour. I did really well from just one agent until they closed in 2016, not naming any names! When the going was good, I was happy being with one, when it wasn’t`t so good, I didn’t know where to turn. It was only a year ago, I discovered the possibility of submitting non exclusively, I concentrate on footage now, but wished I`d started submitting to all sooner, so my graph compared to yours is still in its early days, but will be interesting to see how my graph will look in a year or so.

Thanks Paul! I can’t imagine being exclusive with any one agency to be honest – just too risky. A bit like putting all your savings in one stock in the market! Hope your new strategy pays dividends!

When the going was good, I didn’t feel the need to look else where. Although someone once did ask me what I would do if they closed, unfortunately, I didn’t have answer. It is obvious now, it was not a good idea, hindsight is a wonder full thing. And being with multiple agents, is hard work, but probably for the best, if one is down, hopefully the others compensate etc. Indeed, I think this last year I have worked the hardest I have ever worked, so hoping it will pay off!